62

5. EQUIPMENT AND LAND

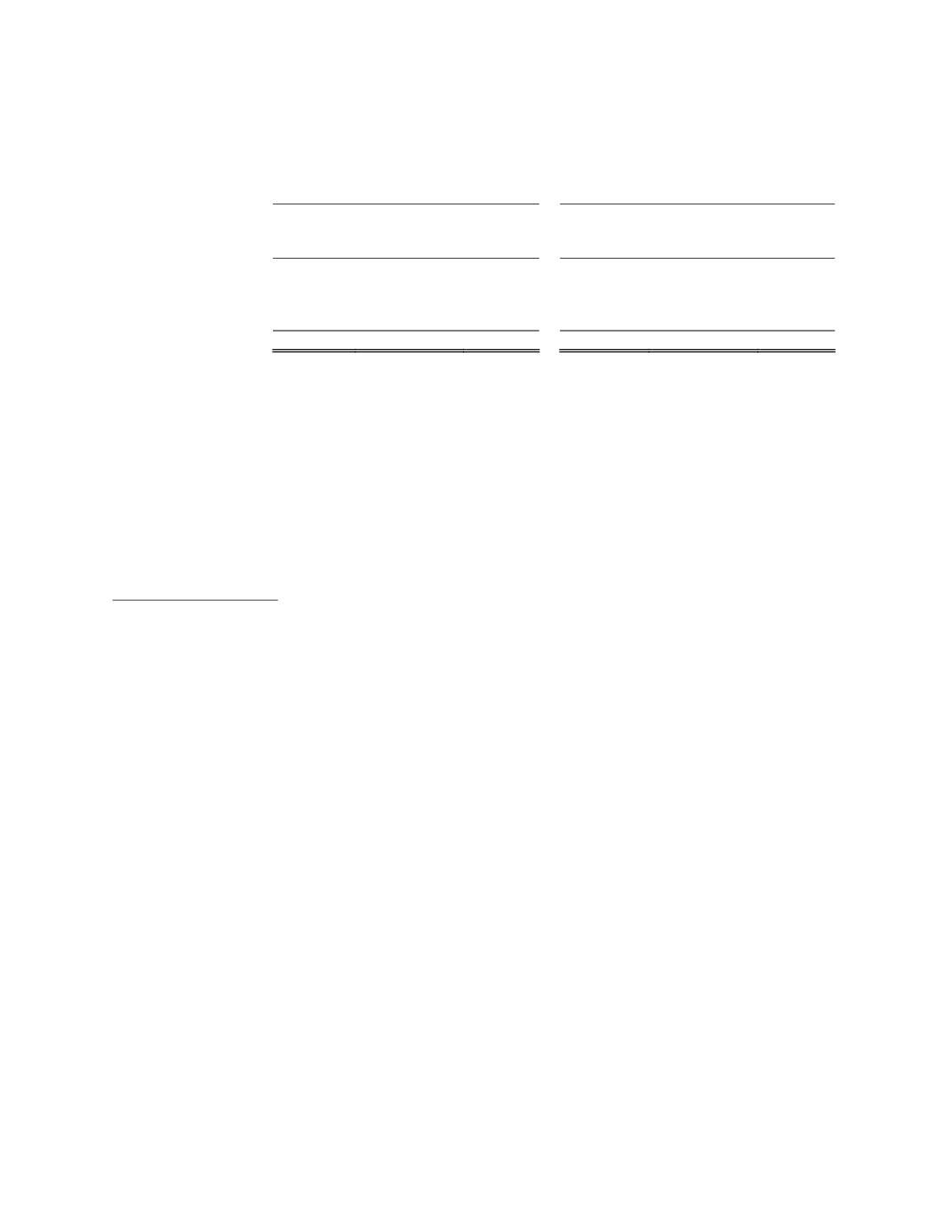

At December 31, 2015 and 2014, equipment consisted of the following:

December 31, 2015

December 31, 2014

Cost

Accumulated

depreciation

Net

book

value

Cost

Accumulated

depreciation

Net book

value

Computer equipment

$ 186 $ 178

$ 8 $ 189 $ 168

$ 21

Furniture

106

72

34

111

64

47

Geological equipment

488

371

117

488

319

169

Vehicles

221

153

68

221

114

107

$ 1,001

$ 774

$ 227 $ 1,009

$ 665

$ 344

Depreciation expense for the year ended December 31, 2015 and 2014 was $118 and $210, respectively.

We evaluate the recoverability of the carrying value of equipment when events and circumstances indicate that such

assets might be impaired.

On April 29, 2013, we completed a land acquisition from the state of Wyoming in conjunction with a third-

party land exchange, resulting in an additional 640 acres being owned by the Company and subject to a royalty

retained by the state of Wyoming. The royalty is a non-participating interest at the royalty rate commensurate with

the state or federal royalty rate, whichever is higher, for any such mineral(s), at the time of development. The

property is immediately adjacent to our mine site, and the cash consideration paid was $980.

6. ADDITIONAL PAID IN CAPITAL

Stock-based compensation

We have options outstanding and exercisable that were issued under two plans, the Fixed Stock Option

Plan (“FSOP”) and the 10% Rolling Stock Option Plan (“RSOP”).

The FSOP was originally approved by shareholders on December 11, 2002 and subsequently approved by

shareholders on December 7, 2009, following certain amendments to the FSOP. The FSOP expired upon the

adoption of the 10% Rolling Stock Option Plan, which was approved by shareholders on December 2, 2011, and as

such, we may no longer grant options under the FSOP. However, the terms of the FSOP continue to govern all prior

awards granted under such plan until such awards have been cancelled, forfeited or exercised in accordance with the

terms thereof. Under the FSOP, we could grant stock options for up to 5,779,347 common shares to eligible

directors, officers, employees or consultants. The maximum term of an option was five years. The exercise price of

an option was not less than the closing price on the last trading day preceding the grant date

.

All options granted

under the FSOP vested as follows: 20% upon each of 4 months, 8 months, 12 months, 15 months and 18 months

after the date of grant. As of December 31, 2015, there were 1,290,000 stock options outstanding under the FSOP

with a weighted-average exercise price of $7.74, all of which were exercisable.

On December 2, 2011, at the Annual General Meeting, our shareholders approved by way of an ordinary

resolution the terms of a new plan, the RSOP, which established the maximum number of common shares which

may be issued under the RSOP as a variable amount equal to 10% of the issued and outstanding common shares on a

non-diluted basis. Under the RSOP, our Board of Directors may from time to time grant stock options to individual

eligible directors, officers, employees or consultants. The maximum term of any stock option is 10 years. The

exercise price of a stock option is not less than the closing price on the last trading day preceding the grant date

.

The Board retains the discretion to impose vesting periods on any options granted. All options granted to date vest

as follows: 20% upon each of 4 months, 8 months, 12 months, 15 months and 18 months after the date of grant. As

of December 31, 2015, there were 3,288,700 stock options outstanding under the RSOP with a weighted-average

exercise price of $2.53, of which 2,606,500 options were exercisable with a weighted-average exercise price of

$3.07.