64

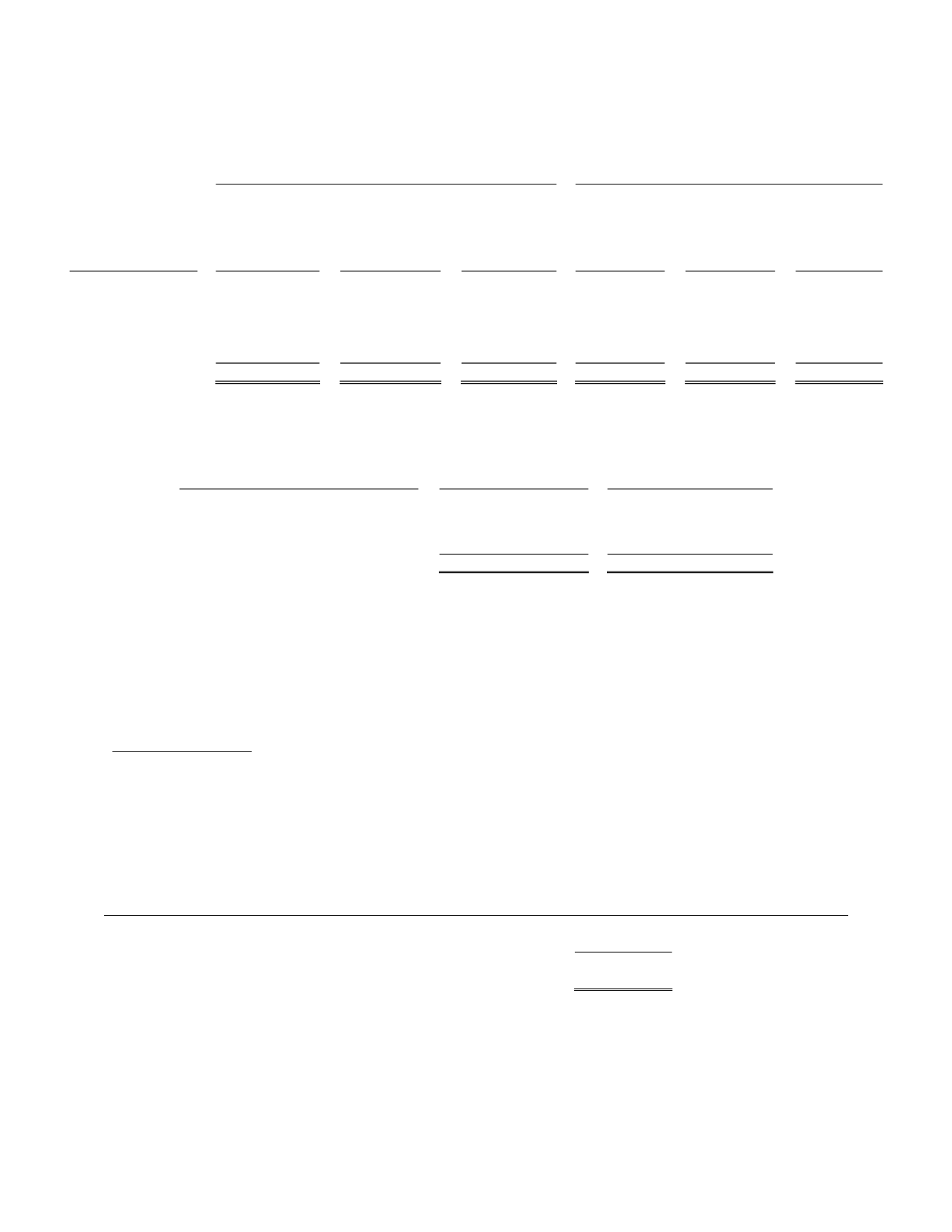

The following table summarizes information about stock options outstanding and exercisable at December

31, 2015:

Outstanding Stock Options

Exercisable Stock Options

Range of Exercise

Prices

Number

Outstanding

Weighted-

Average

Remaining

Contractual

Life (in years)

Weighted-

Average

Exercise Price

Number

Exercisable

Weighted-

Average

Remaining

Contractual

Life (in

years)

Weighted-

Average

Exercise

Price

$0.32 – $2.00

1,608,700

3.81

$ 0.78

926,500

3.41

$ 1.01

$2.01 – $4.00

737,000

1.90

3.30

737,000

1.90

3.30

$4.01 – $6.00

943,000

1.05

4.91

943,000

1.05

4.91

$6.01 – $8.00

1,175,000

0.27

7.41

1,175,000

0.27

7.41

$8.01 +

115,000

0.03

10.91

115,000

0.03

10.91

4,578,700

1.93

$ 3.99

3,896,500

1.51

$ 4.61

A summary of stock option activity as of December 31, 2015 and changes during the year then ended are

presented below.

Non-vested Stock Options

Number Outstanding

Weighted Average

Grant Date Fair Value

Non-vested at December 31, 2014

395,000

$ 0.71

Granted

999,000

0.24

Vested

(709,100)

0.49

Cancelled/forfeited

(2,700)

0.44

Non-vested at December 31, 2015

682,200

0.25

The stock-based compensation cost recognized in our consolidated statements of operations and

comprehensive loss for the years ended December 31, 2015 and 2014 was $254 and $517, respectively. As of

December 31, 2015, there was $71 of unrecognized compensation cost related to 682,200 unvested stock options.

This cost is expected to be recognized over a weighted-average remaining period of approximately 0.65 years. The

total intrinsic value of options exercised in each of the periods ended December 31, 2015 and 2014 was $2 and

$167, respectively. At December 31, 2015, there was no aggregate intrinsic value of outstanding and exercisable

stock options.

Options and Warrants

The Company issued warrants, each exercisable for one of the Company’s common shares, to investors in

connection with registered direct offerings of the Company that closed on September 27, 2013 and April 29, 2015.

In addition, the Company issued warrants to a placement agent in connection with each offering, under the same

terms as those issued to investors. The exercise price and exercise period are outlined below:

Financing

Investor

Warrants

Placement

Agent

Warrants

Total

Warrants

Exercise

Price

Expiration

Date

September 27, 2013 offering

1,338,688

133,869

1,472,557

$4.15

9/27/16

April 29, 2015 offering

2,615,385

261,539

2,876,924

$0.85

4/29/18

Total Warrants Outstanding as of

December 31, 2015

4,349,481

The value of the warrants issued to the placement agent (non-employee) for its services in connection with

the April 29, 2015 offering was offset against the proceeds of the financing. The Company used a Black-Scholes

model with inputs including a market price of the Company’s common shares of $0.72, an exercise price of $0.85, a

three-year term, volatility of 81.0%, a risk-free rate of 0.91% and no assumed dividends. The value of the warrants

issued to the placement agent for its services in connection with the April 29, 2015 offering was estimated at $91.