RARE ELEMENT RESOURCES LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Expressed in thousands of U.S. Dollars, except share and per share amounts, unless otherwise noted)

82

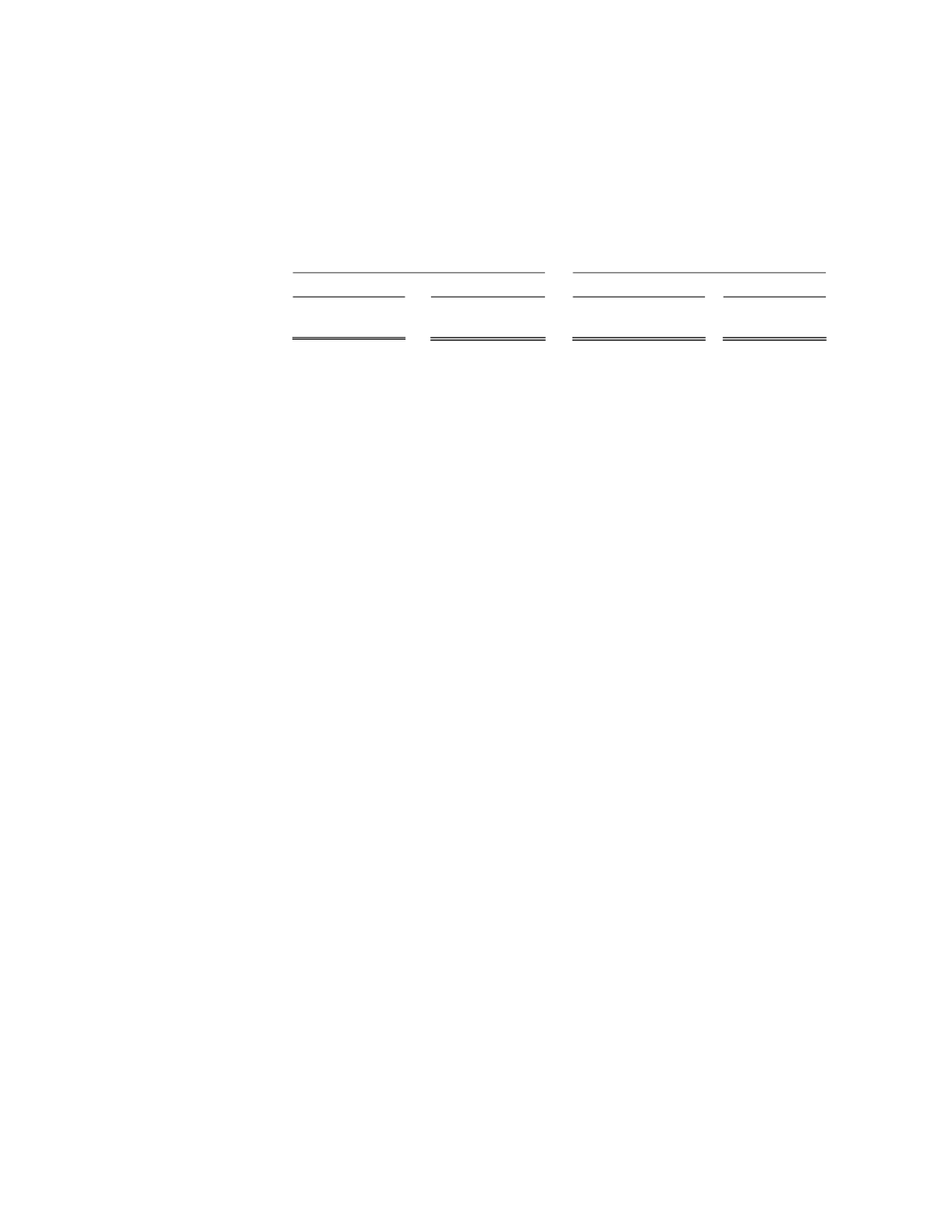

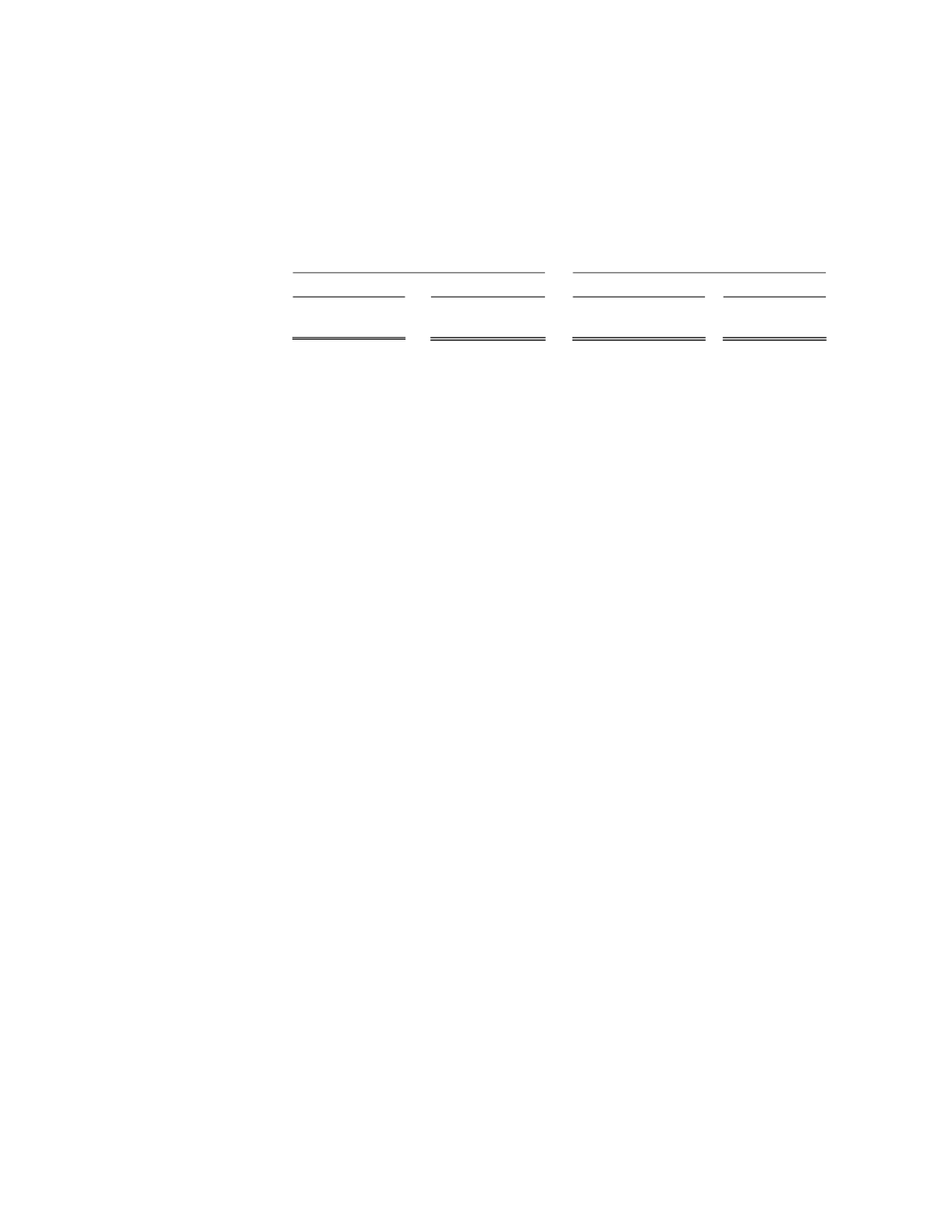

10. SUPPLEMENTAL DISCLOSURE WITH RESPECT TO CASH FLOWS

Supplemental cash flow information for the respective periods is as follows:

For the years ended December 31,

For the six-month

period ended

December 31,

For the fiscal

year ended

June 30,

2014

2013

2012

2012

Other Information

Interest received

$ 77

$ 531

$ 178

$ 494

11. RETIREMENT PLAN

Beginning on January 1, 2012, the Company began sponsoring a qualified tax-deferred savings plan in accordance with

the provisions of Section 401(k) of the U.S. Internal Revenue Code, which is available to permanent, full-time U.S.

employees after the first day of the month following their hire date. Employees can contribute up to 100% of their

compensation, but not to exceed the maximum allowable contribution amount under IRS rules. We match 100% of an

employee’s contributions up to 3% and 50% of an employee’s contribution between 3% and 5% for a total contribution

of up to 4%. The Company’s contributions vest immediately. Our expense to match employee contributions made

during the years ended December 31, 2014 and 2013, the six months ended December 31, 2012 and the fiscal year

ended June 30, 2012 was $86, $95, $45 and $28, respectively.

12. SEGMENTED INFORMATION

The Company operates in a single reportable operating segment, being the exploration of mineral properties.