RARE ELEMENT RESOURCES LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Expressed in thousands of U.S. Dollars, except share and per share amounts, unless otherwise noted)

79

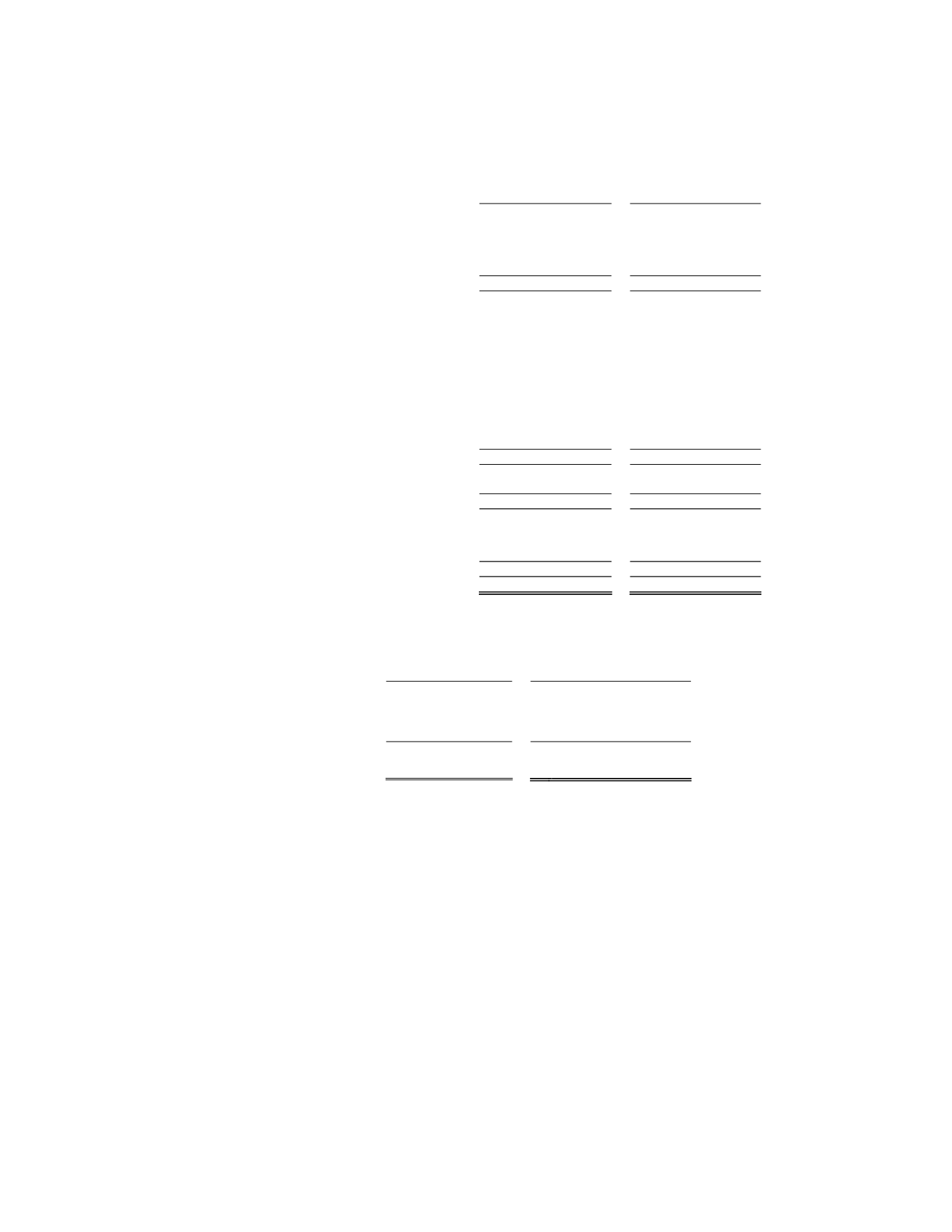

Our future tax assets and liabilities at December 31, 2014 and 2013 include the following components:

As of December 31,

As of December 31,

2014

2013

Deferred tax assets:

Current:

Accrued vacation

$ 39

$ 34

Reclamation provision

57

70

Derivative transactions

-

35

96

139

Non-Current:

Noncapital loss carryforwards, Canada

2,546

2,316

Capital loss carryforwards, Canada

7

3

Net operating loss carryforwards, U.S.

11,053

8,122

Mineral properties

14,244

13,421

Share issue costs

-

-

Reclamation provision

69

72

Equipment

115

74

Share based compensation

4,020

4,047

Research and development

1,882

1,186

Other

-

-

33,936

29,241

Deferred tax assets

34,032

29,380

Valuation allowance

(34,032)

(29,380)

Net

$ -

$ -

Deferred tax liabilities:

Non-Current:

Other

-

-

Deferred tax liabilities

-

-

Net deferred tax asset/(liability)

-

-

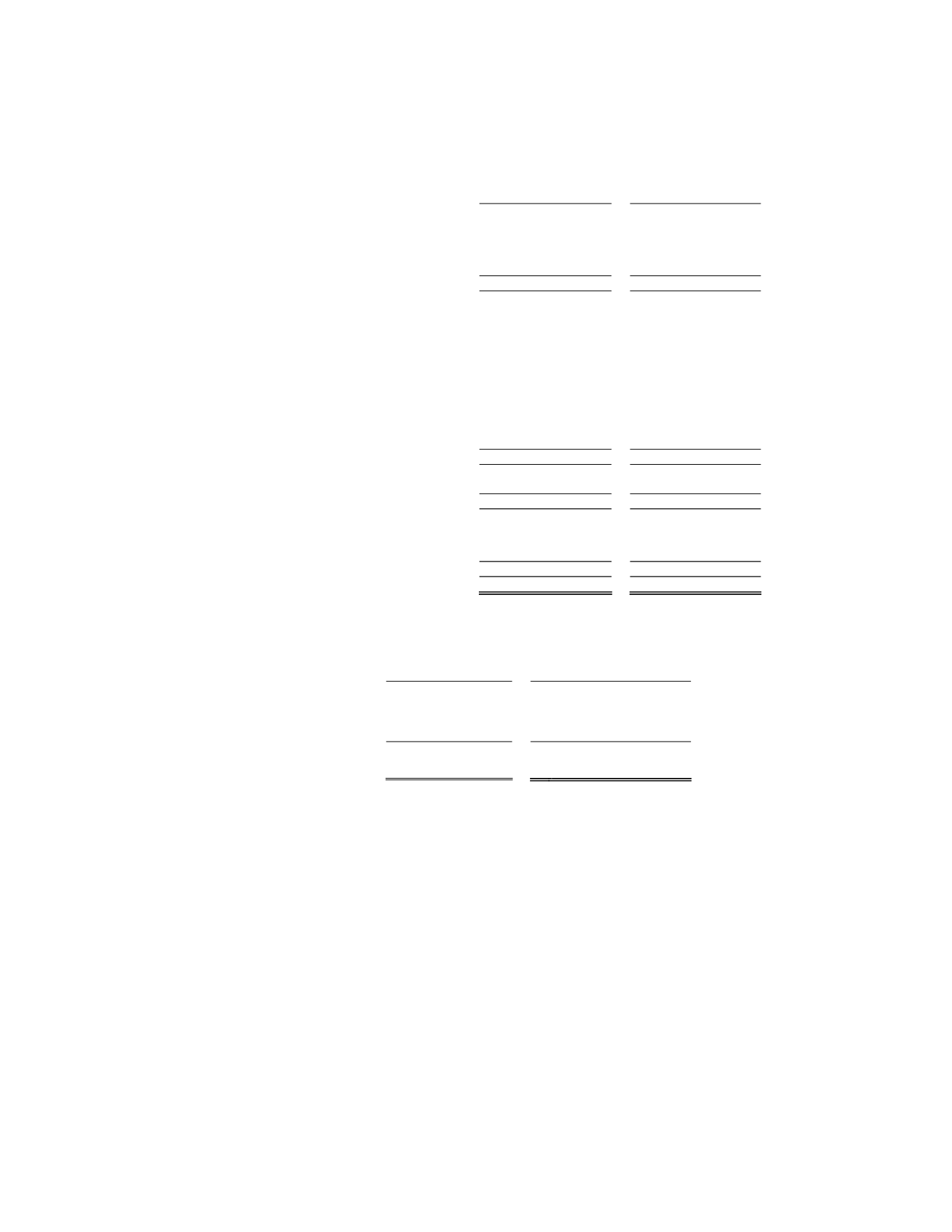

The composition of our valuation allowance by tax jurisdiction is summarized as follows:

As of December 31,

2014

2013

Canada

$ 3,055

$ 2,756

United States

30,977

26,624

Total valuation

allowance

$ 34,032

$ 29,380

The valuation allowance increased $4,652 from the period ended December 31, 2013 to the calendar year ended

December 31, 2014 and $6,452 from the fiscal year ended December 31, 2012 to the period ended December 31,

2013. This was the result of an increase in the net deferred tax assets, primarily net operating loss carryforwards

("NOLs"), equity compensation for U.S. residents, exploration spending on mineral properties, research and

experimental spending, and change in tax rates. Because we are unable to determine whether it is more likely than

not that the net deferred tax assets will be realized, we continue to record a 100% valuation against the net deferred

tax assets.

At December 31, 2014, we had U.S. net operating loss carryforwards of approximately $34,486, which expire from

2018 to 2034. In addition, we had Canadian non-capital loss carryforwards of approximately CDN$9,792, which

expire from 2015 to 2034. As of December 31, 2014, there were Canadian capital loss carryforwards of CDN$59.

A full valuation allowance has been recorded against the tax effected U.S. and Canadian loss carryforwards as we do

not consider realization of such assets to meet the required 'more likely than not' standard.

Section 382 of the Internal Revenue Code could apply and limit our ability to utilize a portion of the U.S. net

operating loss carryforwards. No Section 382 study has been completed; therefore, the actual usage of U.S. net

operating loss carryforwards has not been determined.