RARE ELEMENT RESOURCES LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Expressed in thousands of U.S. Dollars, except share and per share amounts, unless otherwise noted)

81

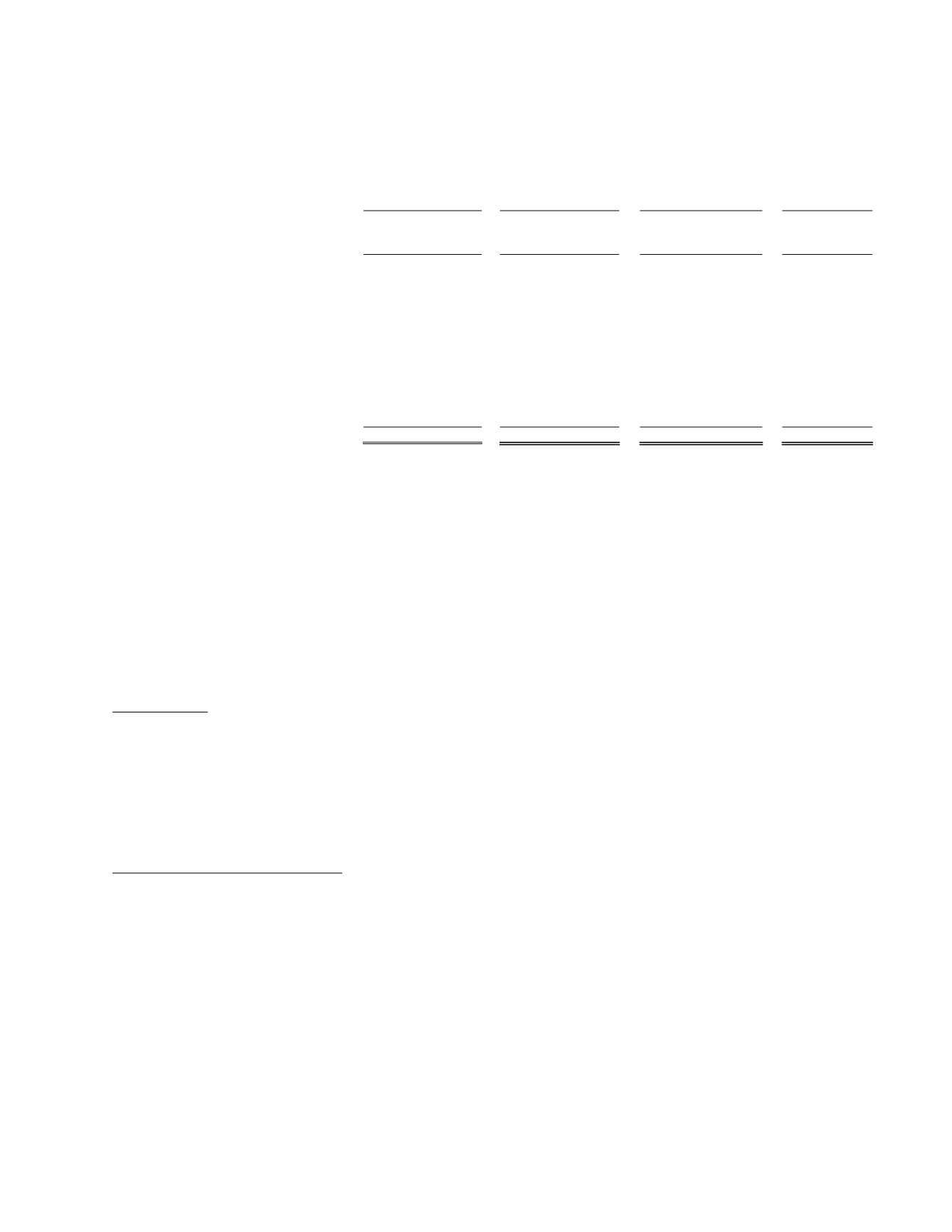

A reconciliation of expected income tax on net income at statutory rates is as follows:

As of December 31,

As of December 31,

As of December 31,

As of June 30,

2014

2013

2012

2012

Net income (loss)

$ (14,029)

$ (22,246)

$ (15,430)

$ (34,994)

Statutory tax rate

26.00%

25.75%

25.00%

25.00%

Tax expense (recovery) at statutory rate

(3,648)

(5,728)

(3,857)

(8,749)

Foreign tax rates

(928)

(1,372)

(1,695)

(2,911)

Change in tax rates

27

162

(1,067)

(9)

Share issuance costs amortization

(220)

(243)

(91)

300

Stock-based compensation

155

391

(2,617)

2,689

Nondeductible expenses

5

8

10

669

Prior year true-up for loss carryovers

20

851

(231)

(353)

Prior year true-up for property basis adjustments

(63)

(521)

246

(2,876)

Unrecognized benefit of non-capital losses

-

-

-

-

Other

-

-

1

4

Change in valuation allowance

4,652

6,452

9,301

11,236

Income tax expense (recovery)

$ -

$ -

$ -

$ -

We do not have any unrecognized income tax benefits. Should we incur interest and penalties relating to tax

uncertainties, such amounts would be classified as a component of the interest expense and operating expense,

respectively.

Rare Element and its wholly-owned subsidiary, Rare Element Resources Holdings, Ltd., file income tax returns in

the Canadian federal jurisdiction and provincial jurisdictions, and its wholly-owned subsidiary, Rare Element

Resources, Inc., files in the U.S. federal jurisdiction and various state jurisdictions. The years still open for audit are

generally the current year plus the previous three. However, because we have NOLs carrying forward, certain items

attributable to closed tax years are still subject to adjustment by applicable taxing authorities through an adjustment

to tax losses carried forward to open years.

9. COMMITMENTS AND CONTINGENCIES

Restricted cash

On August 28, 2012, the Company received notification from the Wyoming Department of Environmental Quality

(“WDEQ”) that the WDEQ had accepted a surety bond in the amount of $430 for our required reclamation program

for land disturbances that occur during our exploration programs at the Bear Lodge REE Project. Upon acceptance,

the WDEQ released the previously restricted funds back to the Company. The surety bond does not require the

Company to restrict any cash as collateral. As such, the $422 discussed below and previously recorded as restricted

cash was reclassified to cash and cash equivalents during the six-month period ended December 31, 2012.

Potential environmental contingency

Our exploration and development activities are subject to various federal and state laws and regulations governing the

protection of the environment. These laws and regulations are continually changing and generally becoming more

restrictive. The Company conducts its operations so as to protect public health and the environment and believes its

operations are materially in compliance with all applicable laws and regulations. We have made, and expect to make in

the future, expenditures to comply with such laws and regulations. The ultimate amount of reclamation and other

future site-restoration costs to be incurred for existing mining interests is uncertain.