RARE ELEMENT RESOURCES LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Expressed in thousands of U.S. Dollars, except share and per share amounts, unless otherwise noted)

75

On December 2, 2011, at the Annual General Meeting, our shareholders approved by way of an ordinary resolution

the terms of a new plan, the RSOP, which established the maximum number of common shares which may be issued

under the RSOP as a variable amount equal to 10% of the issued and outstanding common shares on a non-diluted

basis. Under the RSOP, our Board of Directors may from time-to-time grant stock options to individual eligible

directors, officers, employees or consultants. The maximum term of any stock option is ten years. The exercise

price of a stock option is not less than the closing price on the last trading day preceding the grant date, less

allowable discounts in accordance with the policies of the TSX and the NYSE MKT. The Board retains the

discretion to impose vesting periods on any options granted. All options granted to date vest as follows: 20% upon

each of 4 months, 8 months, 12 months, 15 months and 18 months after the date of grant. As of December 31, 2014,

there were 2,430,500 stock options outstanding under the RSOP with a weighted-average exercise price of $3.42, of

which 2,035,500 options were exercisable with a weighted-average exercise price of $3.81.

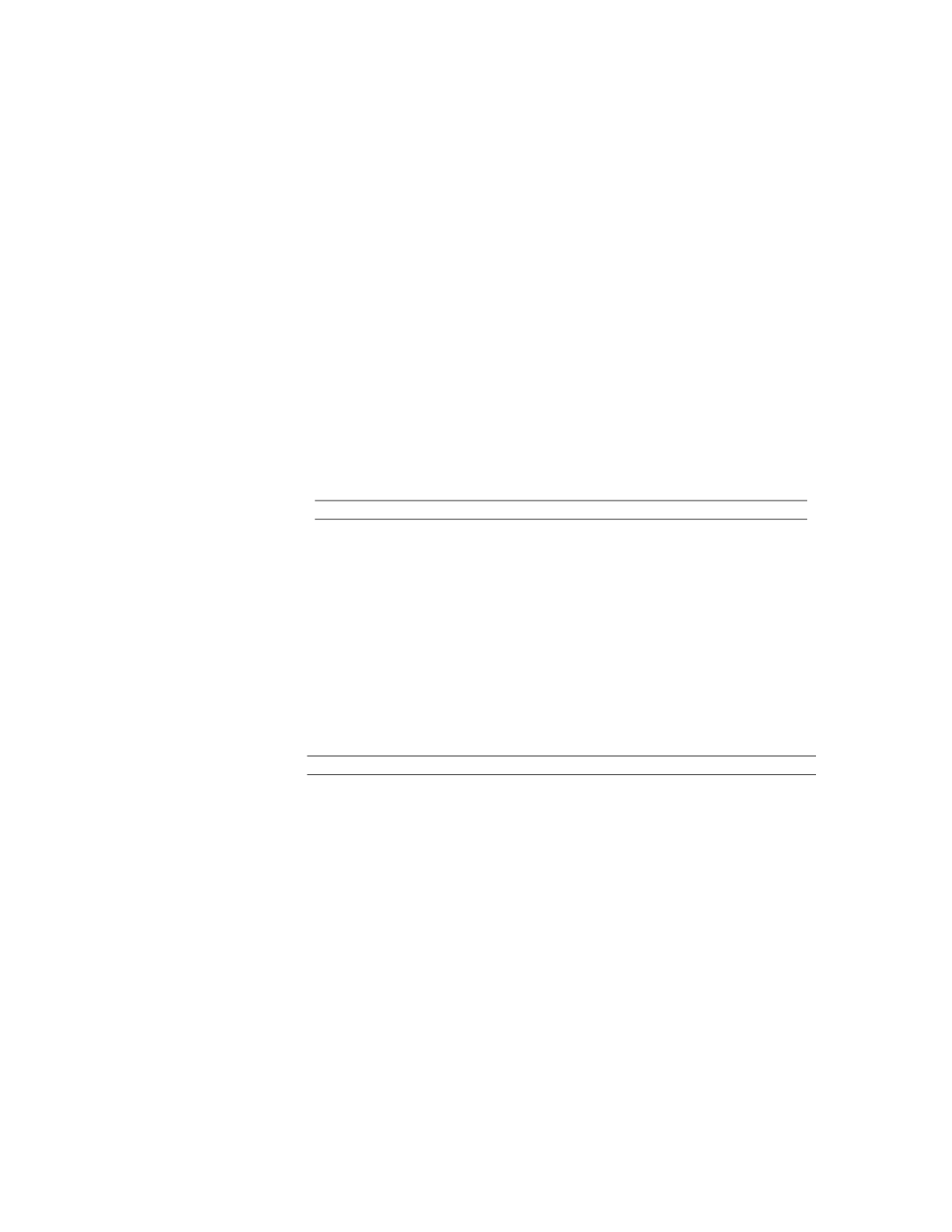

The fair value of stock option awards granted to directors, officers or employees of the Company are estimated on

the grant date using the Black-Scholes option pricing model and the closing price of our common shares as quoted

on either the TSX or NYSE MKT on the grant date. The significant assumptions used to estimate the fair value of

stock option awards using the Black-Scholes model are as follows:

For the years ended

December 31,

For the six-month

period ended

December 31,

For the fiscal year

ended June 30,

2014

2013

2012

2012

Risk-free interest rate

0.93 – 0.99%

0.59 – 0.75%

0.35 - 0.39%

0.12 - 0.36%

Expected volatility

74 – 79%

80 – 84%

80%

80%

Expected dividend yield

Nil

Nil

Nil

Nil

Expected term in years

3.3

3.0

3.0

3.0 – 5.0

Estimated forfeiture rate

3.7%

0 – 3.9%

0%

0%

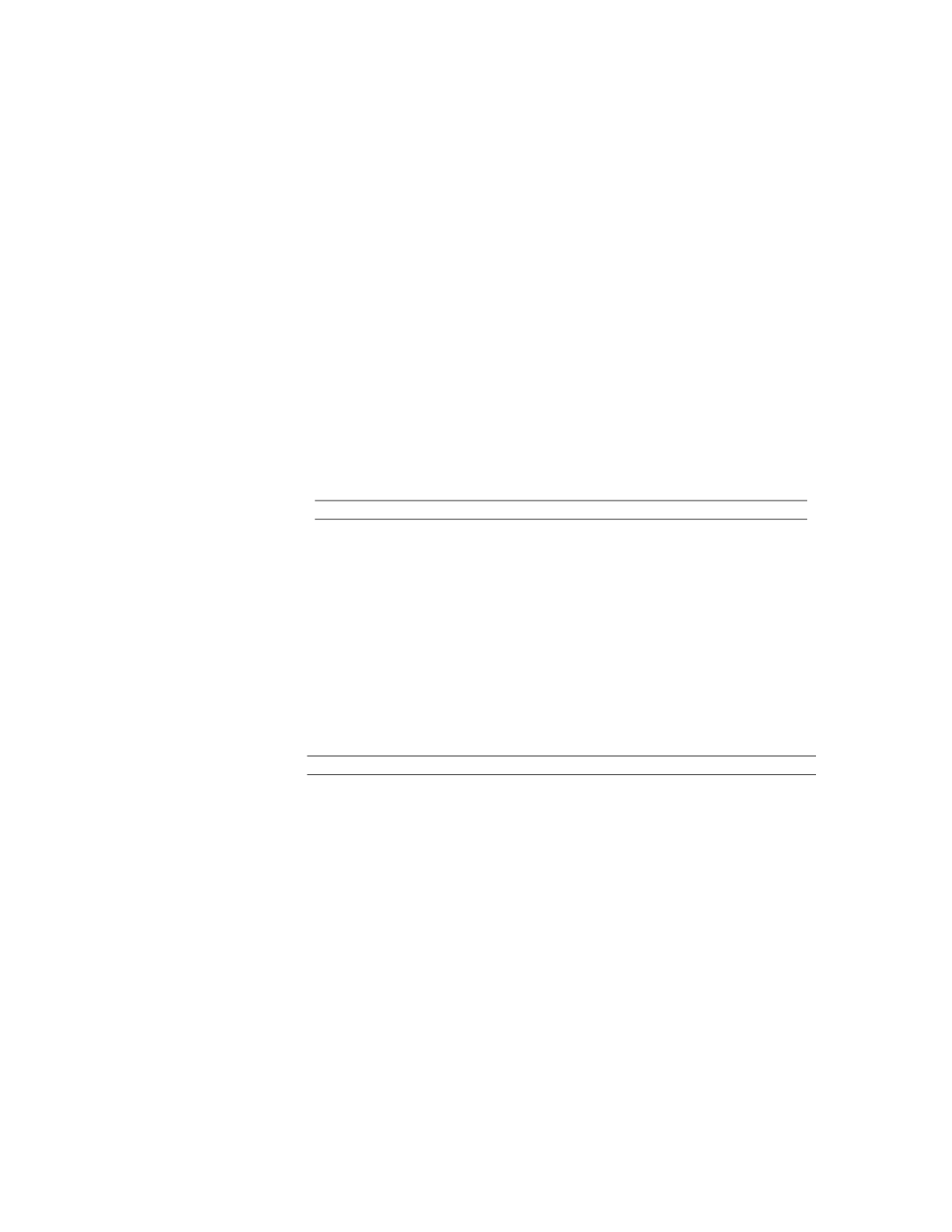

The fair value of stock option awards granted to consultants of the Company is estimated on the vesting date using

the Black-Scholes option pricing model and the closing price of our common shares as quoted on either the TSX or

NYSE MKT on the vesting date. The significant assumptions used to estimate the fair value of stock option awards

using the Black-Scholes models are as follows:

For the years ended December 31,

For the six-month

period ended

December 31,

For the fiscal year

ended June 30,

2014

2013

2012

2012

Risk-free interest rate

0.99%

0.36 – 0.52%

0.35 - 0.39%

0.19 - 0.71%

Expected volatility

74-79%

80 - 84%

80 - 109%

80 - 113%

Expected dividend yield

Nil

Nil

Nil

Nil

Expected term in years

3.3

3.0 – 5.0

3.0 – 5.0

3.0 – 5.0

Estimated forfeiture rate

3.7%

0 – 3.9%

0%

0%