86

The Board shall have the power, without shareholder approval, at any time and from time to time, either

prospectively or retrospectively, to amend, suspend or terminate the 10% Rolling Stock Option Plan or any option

granted under the 10% Rolling Stock Option Plan provided always that any such amendment shall not, without the

consent of the option holder, alter the terms or conditions of any option or impair any right of any option holder

pursuant to any option awarded prior to such amendment in a manner materially prejudicial to such option holder.

Additionally, such termination shall be subject to any necessary stock exchange, regulatory or shareholder approval.

The 10% Rolling Stock Option Plan was initially approved by shareholders of the Company at the annual

and special meeting of shareholders on December 2, 2011.

Equity Compensation Plan Information

For information in tabular format regarding those securities of the Company which have been authorized

for issuance under equity compensation plans as at December 31, 2015, see Part II, Item 5. Market for Registrant’s

Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities – Equity Compensation

Plan Information.”

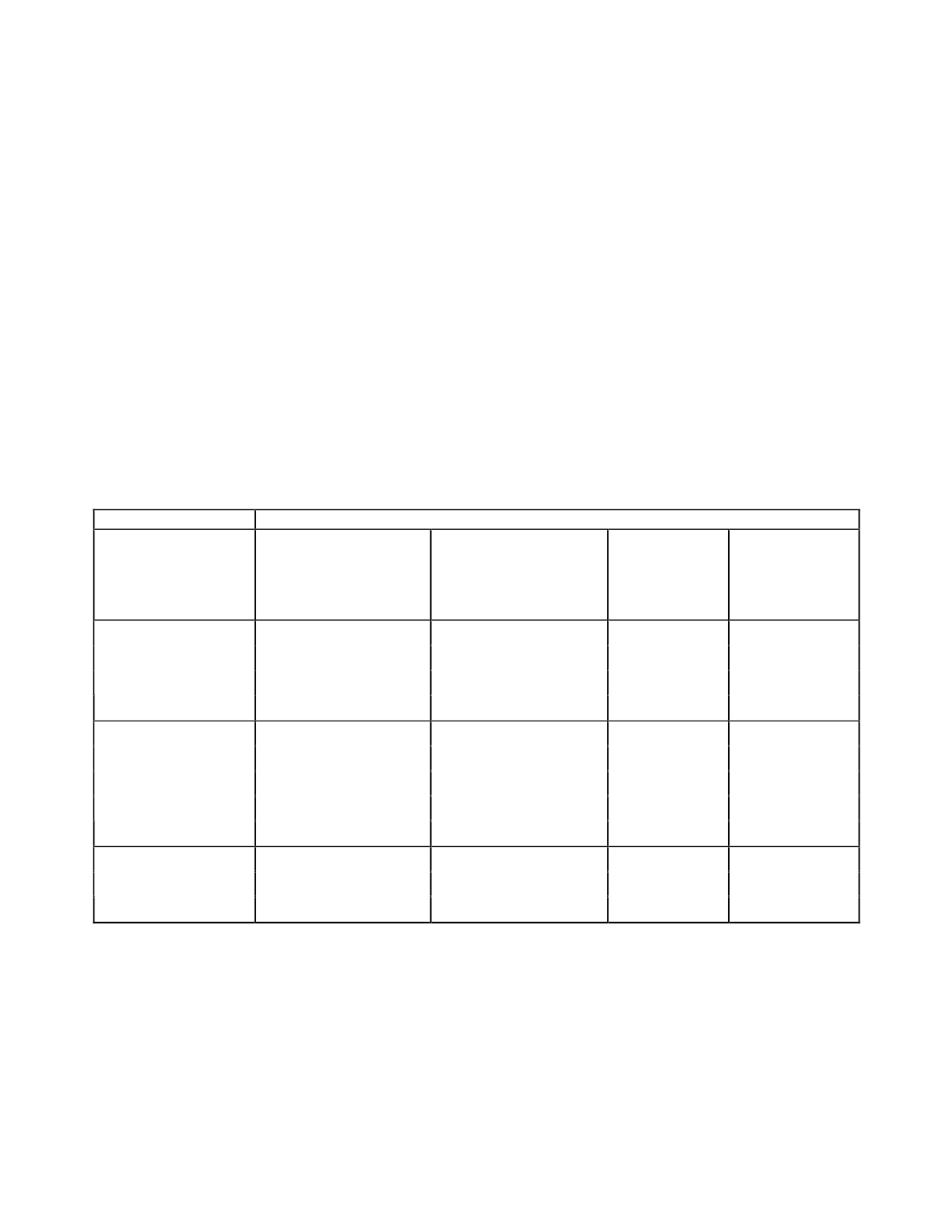

Outstanding Equity Awards at Fiscal Year-End

The following table sets forth the outstanding option awards held by the NEOs of the Company as of

December 31, 2015. All grants were made under the 10% Rolling Stock Option Plan.

Option awards

Name

Number of securities

underlying unexercised

options

(#)

exercisable

Number of securities

underlying unexercised

options

(#)

unexercisable

Option exercise

price

($)

Option

expiration date

40,000

60,000

0.32

1/22/2020

75,000

-

1.24

12/17/2018

85,000

-

3.61

12/20/2017

Randall J. Scott

200,000

-

4.14

12/15/2016

20,000

30,000

0.32

1/22/2020

50,000

-

1.24

12/17/2018

50,000

-

3.61

12/20/2017

100,000

-

5.14

12/2/2016

Jaye T. Pickarts

250,000

-

10.53

3/16/2016

20,000

30,000

0.32

1/22/2020

50,000

-

1.23

6/12/2019

Paul H. Zink

50,000

-

1.24

12/17/2018

Option Exercises

There were no options exercised by any NEO during the year ended December 31, 2015.

Pension Benefits and Non-Qualified Deferred Compensation

The Company does not have a pension plan that provides for payments or benefits to the NEOs at,

following or in connection with retirement. During the year ended December 31, 2015, the Company did not have

any nonqualified deferred compensation.