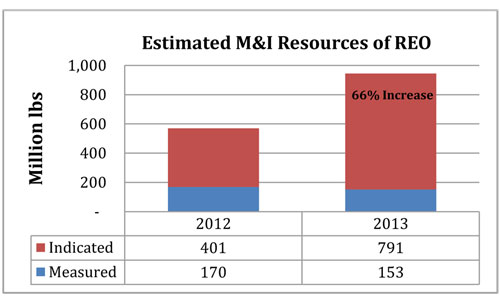

Rare Element Resources Ltd. (NYSE MKT: REE and TSX: RES) (the "Company") today announced a 65% increase to its total Measured and Indicated (M&I) rare earth elements (REE) resources estimate at the Bear Lodge Project, from 571 to 944 million pounds of rare earth oxide (REO).

Lakewood, Colorado---Rare Element Resources Ltd. (NYSE MKT: REE and TSX: RES) (the "Company") today announced a 65% increase to its total Measured and Indicated (M&I) rare earth elements (REE) resources estimate at the Bear Lodge Project, from 571 to 944 million pounds of rare earth oxide (REO). The updated NI 43-101 compliant resource estimate includes the first Indicated resource at the HREE-enriched Whitetail Ridge deposit and high grades of Critical Rare Earth Oxides (CREOs) in all deposits.

Randall J. Scott, President and Chief Executive Officer stated "We are extremely pleased with the meaningful increase in our estimated M&I resource at Bear Lodge. Our work in 2012 resulted in a much larger quantity of REE resource, confirmation of the peripheral zones of HREE-enrichment, and highlights the significance of this growing world-class source of CREOs. The increased M&I resource will be incorporated into the upcoming Feasibility Study, which is on schedule to commence in mid-2013."

Critical Rare Earth Oxides (CREO)

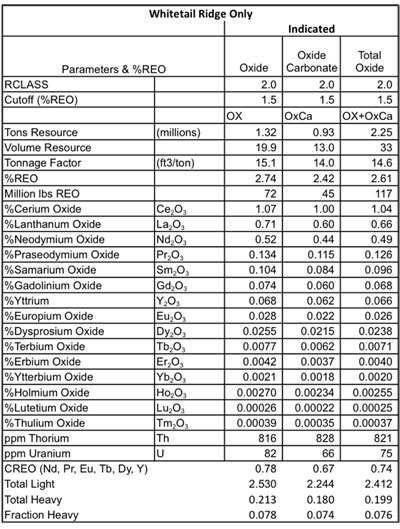

Critical rare earth oxides (CREOs) are those with the highest value, and for which the strongest future growth is projected. We refer here to the oxides of Nd, Pr, Eu, Tb, Dy, and Y as CREOs. The resource estimates for the Greater Bull Hill and Whitetail Ridge REE deposits show high grades for all of the CREOs. The Whitetail Ridge deposit is particularly enriched in the HREE component of the CREOs as well as the exploration targets located further to the west.

Resource Estimate

The updated resource is derived from an REE drill hole database that includes 216 core holes and 16,920 assay samples, completed by the Company between 2008 and the end of 2012. The estimate includes deposits in the Greater Bull Hill area and the HREE-enriched Whitetail Ridge deposit. The drilling indicates significant potential for further expansion of all resources, including additional HREE-enriched resources at the Whitetail Ridge deposit and nearby targets.

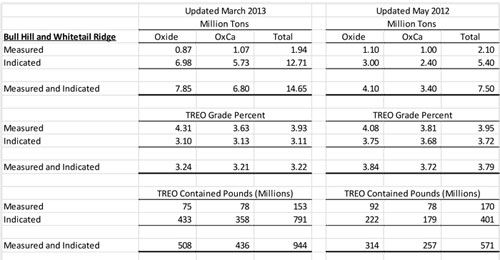

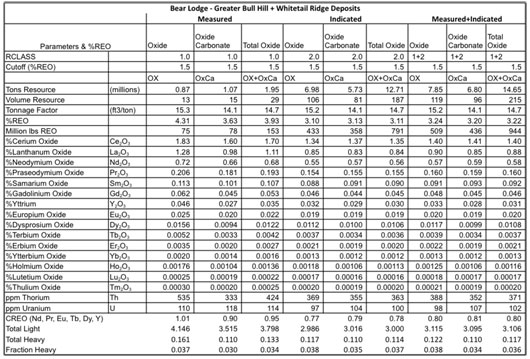

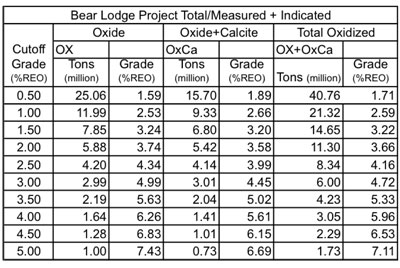

The total M&I mineral resources estimate for the Greater Bull Hill + Whitetail Ridge deposits at a cutoff grade of 1.5% REO is summarized in Tables 1 & 2 for the near-surface oxide (OX) and oxide-carbonate (OxCa) zones. The M&I oxide resources for total REO at a range of cutoff grades is given in Table 3. The estimated REE resource in the Indicated category for the HREE-enriched Whitetail Ridge deposit only is summarized in Table 4.

Subject to a Feasibility Study, the data in Table 2 indicate sufficient M&I oxide resources to support the possibility of a 40+ year mine life at the previously published preliminary feasibility study production rate of 1000 tons per day. The resource data in Table 3 indicate that there may be significant enough tonnages of material at higher grades to support an initial higher-grade/lower production mining option with lower capital costs that could transition into full plant design capacity over a period of several years (for example, 6 million tons grading 4.72% REO at a 3% cutoff grade). This option will be considered in the upcoming Feasibility Study, scheduled to commence mid-2013.

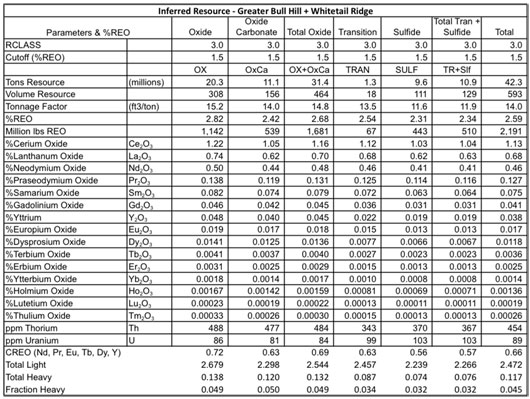

Total estimated REE mineral resources and detailed REO grades in the Inferred category for the Greater Bull Hill area deposits plus Whitetail Ridge are given in Table 5. REE resources in the Inferred category for all mineralization types increased to 42.3 million tons grading 2.59% REO in 2013 from 34.6 million tons at 2.83% REO in 2012. Total Inferred Oxide resources (Ox+OxCa) increased from 25.7 million tons grading 2.86% REO in 2012 to 31.4 million tons at 2.68% REO in 2013.

Geology and Mineralization

The Bull Hill area deposits contain the bulk of the current resources. They comprise steeply-dipping FMR (FeOx-MnOx-REE)-carbonatite dike swarms with dominant northwesterly and subordinate northerly trends mainly intersecting the Bull Hill diatreme breccia. Carbonatite dikes at depth are interpreted to transition toward the surface into either oxide-carbonate bodies or FMR bodies, which range in size from sub-millimeter veinlets to large dikes more than 100 feet (30 m) in width.

The Whitetail Ridge deposit is more enriched in HREEs and is distinguished by a zone of FMR dikes and stockwork that invade the Whitetail Ridge diatreme breccia and adjacent trachyte/phonolite intrusive rocks. Expansion of the Indicated REE resource at Whitetail Ridge is a key objective of the Company's planned 2013 drilling program.

The major dike sets in all of the resource areas are accompanied by peripheral zones of lower-grade stockwork REE mineralization. The term "stockwork" refers to a rock cut by a network of small veins or dikes that contain the mineralization. REE grades in the stockwork zones range between about 0.5% and 2.5% REO. The Company is continuing its investigation of low-cost physical processing methods to upgrade the contained REE mineralization in the stockwork for eventual inclusion with the resources.

Cutoff Grade & Metallurgy

The resource size is sensitive to an assumed cut-off grade, which is sensitive to metallurgical operating costs. See Table 3 for cut-off grade sensitivities. The Company will conduct pilot scale metallurgical testing on more than 21 tons (19.1 tonnes) of mineralized material in 2013 in conjunction with its planned Feasibility Study (FS). Metallurgy of the FMR oxide zone is well established and was reported previously. Metallurgical testing of the oxide-carbonate zone resource is in progress. Bench-scale optimization and variability testing is ongoing for both mineralization types.

Mineral Resources are not Reserves

Mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral resource estimates do not account for minability, selectivity, mining loss, and dilution. These mineral resource estimates are in the measured, indicated, and inferred mineral resource categories. Inferred mineral resources are normally considered too speculative geologically for the application of economic considerations that would enable them to be categorized as mineral reserves. There is also no certainty that these inferred mineral resources will be converted to M&I mineral resource categories through further drilling or into mineral reserves once economic considerations are applied.

The Company announced positive economic results from its Pre-Feasibility Study (PFS) on 1 March 2012, and in a revised news release on 12 April 2012. The PFS established a Proven plus Probable mineral reserve for the Bull Hill deposit that contains 7.9 million tons (7.2M metric tonnes) at a grade of 3.12% REO and at a cutoff grade of 1.1% REO.

Quality Assurance

The mineral resource estimate was completed by Mr. Alan C. Noble, P.E., principal engineer of Ore Reserves Engineering (ORE), and is based on geological interpretations supplied by the Company to ORE and subsequently modified by ORE. Mr. Noble is an independent Qualified Person under NI 43-101 -- Standards of Disclosure for Mineral Projects ("NI 43-101") of the Canadian Securities Administrators, and Mr. Noble has verified the data disclosed in this release. Mr. Noble will prepare the updated NI43-101 report, which will be filed and available under the Company's SEDAR profile at www.sedar.com within 45 days.

The Rare Element Resources' field programs were carried out under the supervision of Dr. James G. Clark, Vice President of Exploration and John T. Ray, who is a Qualified Person for the purposes of National Instrument 43-101 -- Standards of Disclosure for Mineral Projects of the Canadian Securities Administrators. A detailed QA/QC program was implemented for the 2007 through 2012 drill programs. The QA/QC program was organized by Dr. Jeffrey Jaacks. Dr. Jaacks and Dr. Clark have verified the sampling procedures and QA/QC data delivered to ORE. They share the opinion that the data are of good quality and suitable for use in the resource estimate.

A full table of significant drill results from the Company's 2012 exploration program, along with maps and sections detailing the location of the drill holes, are available in our press release dated 11 March 2013 and posted on our website at www.rareelementresources.com.

Markets for Rare Earths

REEs are key components of the green energy technologies and other high-technology applications. Some of the major applications include hybrid automobiles, plug-in electric automobiles, advanced wind turbines, computer hard drives, compact fluorescent light bulbs, metal alloys in steel, additives in ceramics and glass, petroleum cracking catalysts, and many others. Rare earths are critical and enabling metals for the green technologies.

Please refer to the tables in the Appendix for details of the M&I and Inferred tons and grade in this news release. All resources reported herein comply with NI 43-101.

Rare Element Resources Ltd. is a publicly traded mineral resource company focused on exploration and development of rare-earth elements (REEs), with a significant distribution of critical rare earths (CREEs). In addition to the REE exploration and evaluation efforts, the Company controls the Sundance gold project, which is located on the same property in Wyoming.

Neither TSX nor its Regulation Services Provider (as that term is defined in the policies of the TSX) accepts responsibility for the adequacy or accuracy of this release.

Forward Looking Statements

This news release contains forward-looking statements within the meaning of securities legislation in the United States and Canada. Except for statements of historical fact, certain information contained herein constitutes forward-looking statements. Forward looking statements are usually identified by our use of certain terminology, including "will", "believes", "may", "expects", "should", "seeks", "anticipates", "plans", "has potential to", or "intends' or by discussions of strategy or intentions. Forward-looking statements are statements that are not historical facts, and include but are not limited to, mineral resource estimates and their underlying assumptions; the anticipated mine life of the project and possible timing and options being considered in the Feasibility Study. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results or achievements to be materially different from any future results or achievements expressed or implied by such forward-looking statements. Factors that could cause actual results to differ materially include, but are not limited to, our estimates of mineral resources; capital costs estimates; processing technology effectiveness; fluctuations in demand for, and price of, rare earth products; timing of and unexpected events at the Bear Lodge property; delay or failure to receive government approvals and permits; timing and availability of external financing on acceptable terms; the timing of a Feasibility Study and matters that will be discussed therein; plans for pilot scale metallurgical testing; technical, permitting, mining or processing issues; changes in U.S. and Canadian securities markets; and fluctuations in input costs and general economic conditions. There can be no assurance that future developments affecting the Company will be those anticipated by management. Please refer to the discussion of these and other factors in our Form 10-K for the fiscal year ended June 30, 2012. We expect that the above estimates will change as new information is received and that actual results will vary from these estimates, possibly by material amounts. While we may elect to update these estimates at any time, we do not undertake to update any estimate at any particular time or in response to any particular event. Investors and others should not assume that any forecasts in this press release represent management's estimate as of any date other than the date of this press release.

Cautionary Statement

John T. Ray, MS, Rare Element's qualified person under Canadian NI 43-101, supervised the preparation of the scientific and technical information concerning the Company's mineral project contained in this news release. For a description of the key assumptions, parameters and methods used to estimate mineral reserves and resources, as well as data verification procedures and a general discussion of the extent to which the estimates may be affected by any known environmental, permitting, legal, title, taxation, socio-political, marketing or other relevant factors, please see the Technical Reports for our project as filed on SEDAR at www.sedar.com.

Cautionary Note to U.S. Investors - The United States Securities and Exchange Commission permits U.S. mining companies, in their filings with the SEC, to disclose only those mineral deposits that a company can economically and legally extract or produce. We may use certain terms in public disclosures, such as "measured," "indicated," "inferred" and "resources," that are recognized by Canadian regulations, but that SEC guidelines generally prohibit U.S. registered companies from including in their filings with the SEC. U.S. investors are urged to consider closely the disclosure in our Form 10-K which may be secured from us, or from the SEC's website at http://www.sec.gov.

For additional information please refer to the Company's website at www.rareelementresources.com or contact David Suleski, 720-278-2468.

APPENDIX

Figure 1: Growth in Estimated Rare Earth Oxides M&I from 2012 to 2013

Table: 1: Summary of Estimated Measured and Indicated REE mineral resources (at 1.5% REO cutoff grade)

Table 2. Estimated Measured and Indicated REE mineral resources and detailed REO grades for deposits in the Greater Bull Hill area and Whitetail Ridge for the oxide and oxide-carbonate mineralization zones at a 1.5% REO cutoff grade.

Table 3. Estimated Measured and Indicated REE mineral resources for a range of cutoff grades.

Table 4. Estimated Indicated REE mineral resource and detailed REO grades for the Whitetail Ridge deposit only for the oxide and oxide-carbonate mineralization zones at a 1.5% REO cutoff grade.

Table 5. Estimated REE mineral resources and detailed REO grades in the Inferred category for deposits in the Greater Bull Hill area plus Whitetail Ridge for the different oxidation zones of mineralization, including the oxide (OX), oxide-carbonate (OxCa), transitional (tran), and sulfide/unoxidized (sulf) zones, at a 1.5% REO cutoff grade.