55

We expect that we will require between $45 million and $60 million of additional funding over the next two years to

fully support the EIS and permitting processes, ongoing engineering, advanced metallurgical and elemental

separation test work, FS completion, a larger-scale demonstration facility development and operation and other

corporate expenses. In addition, subject to positive FS results, financing, and board approval, we will require a

substantial portion of the remaining estimated initial project capital costs to initiate project construction. The actual

amount of the funding required prior to receiving all of the necessary operating approvals will depend on the timing

of such approvals as well as the level of expenditures as approved by the Company’s Board of Directors. There is no

assurance that such financing will be available, or available on terms acceptable to the Company.

Off-Balance Sheet Arrangements

We have no off-balance sheet arrangements required to be disclosed in this Annual Report.

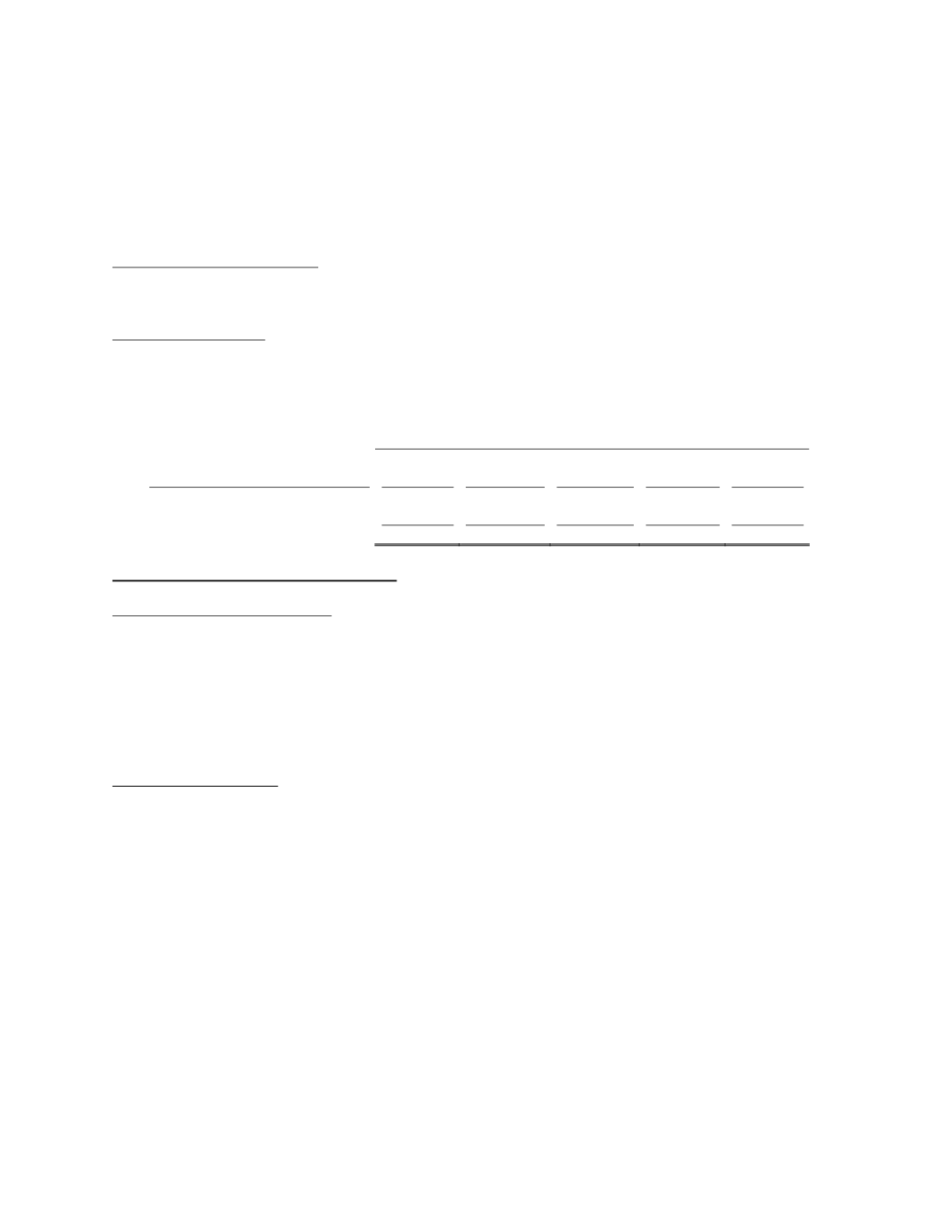

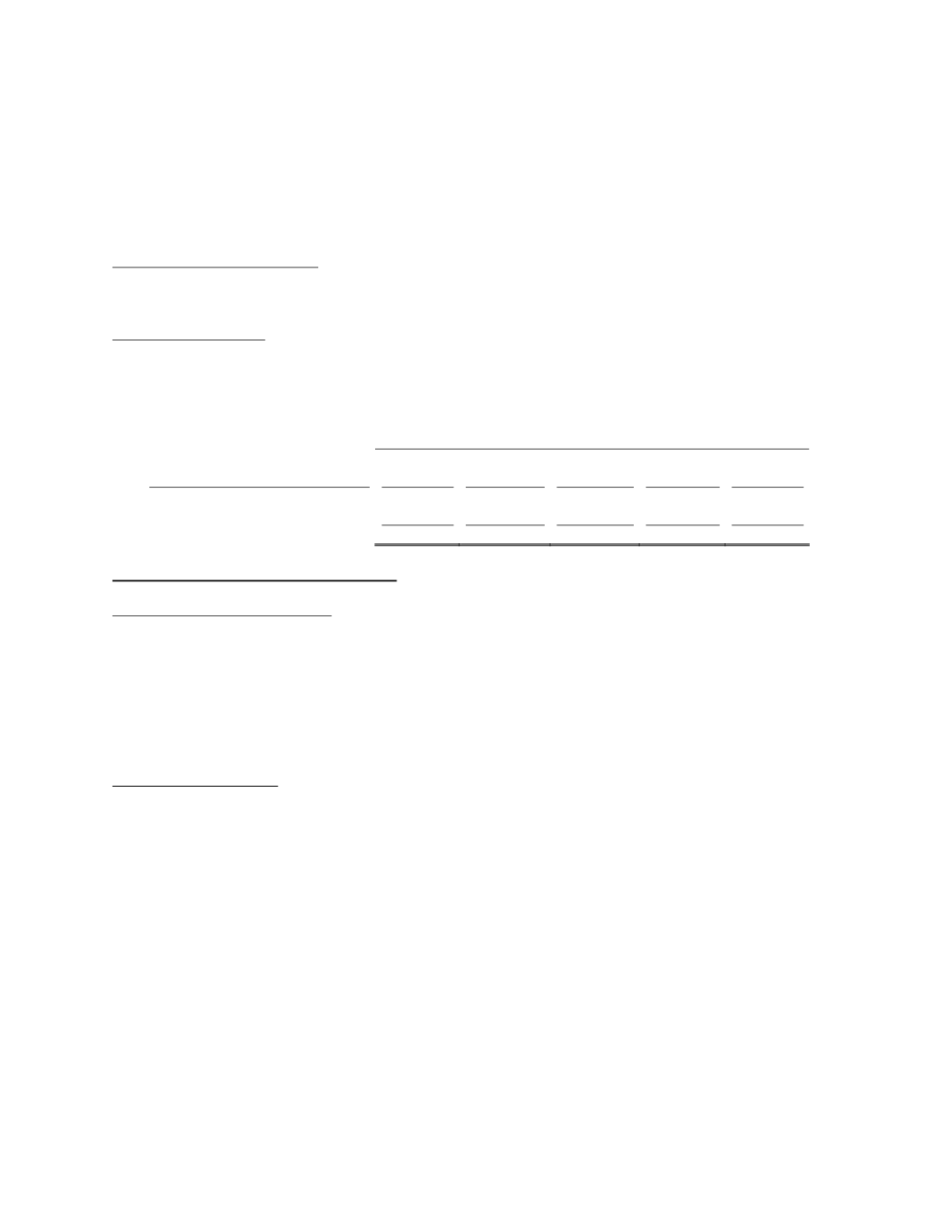

Contractual Obligations

At December 31, 2014, our contractual obligations consisted of our operating lease obligation of $224 associated

with our Lakewood, Colorado corporate office as well as facilities in Sundance, WY. The timing associated with

these lease obligations is outlined below:

Payments Due by Period

Contractual obligations

Total

Less than 1

Year

2-3

Years

3-5

Years

More than

5 Years

Operating lease obligations

$224

$167

$57

$0

$0

Total

$224

$167

$57

$0

$0

CRITICAL ACCOUNTING ESTIMATES

Exploration and development costs

Exploration costs are expensed as incurred. When it is determined that a mining deposit can be economically and

legally extracted or produced based on established proven and probable reserves, development costs related to such

reserves incurred after such determination will be considered for capitalization. The establishment of proven and

probable reserves is based on results of feasibility studies that indicate whether a property is economically feasible.

Upon commencement of commercial production, capitalized costs will be transferred to the appropriate asset

category and amortized over their estimated useful lives. Capitalized costs, net of salvage values, relating to a

deposit that is abandoned or considered uneconomic for the foreseeable future, will be written off.

Stock-based compensation

We account for share-based compensation under the provisions of Financial Accounting Standards Board

Accounting Standards Certification (“ASC”) 718, “Compensation – Stock Compensation.” Under the fair value

recognition provisions, stock-based compensation expense is measured at the grant date for all stock-based awards

to employees and directors and is recognized as an expense over the requisite service period, which is generally the

vesting period. The Black-Scholes option valuation model is used to calculate fair value.

We account for stock compensation arrangements with non-employees in accordance with ASC 718 and ASC 505-

15, “Equity,” which require that such equity instruments are recorded at their fair value on the measurement date.

The measurement of stock-based compensation is subject to periodic adjustment as the underlying equity

instruments vest. Non-employee stock-based compensation charges are amortized over the vesting period on a

straight-line basis. For stock options granted to non-employees, the fair value of the stock options is also estimated

using a Black-Scholes valuation model.